Showing posts with label budgeting. Show all posts

Showing posts with label budgeting. Show all posts

Sunday, January 22, 2012

Getting Back on Track

Today I was wondering...Why is it SO easy to get off track?

I guess it's just something about our human nature that makes us get distracted. In one of the old hymns it says "Prone to wander, Lord, I feel it. Prone to leave the God I love." How true is that? We are not just prone to wandering in our Christian walks but also in the day to day mundane things of our lives.

Back in September my husband and I moved to Saint Joseph, Missouri, to start a new ministry. Over the past couple of months things have been going absolutely great in the youth ministry. We are really holding tight and not straying from the path God has laid out before us. We even had a really fun event on Friday night that had a much bigger turn out than we expected.

However, we were sub-consciously allowing ourselves to wander in other areas. Since we moved our routine has been disturbed and the first things to go were eating healthy, exercising and living by our budget. We realized these things at different times. At the end of last year we took steps to try and get our budget back in order, but it wasn't until the last week or so that we have really been trying to find the path of eating right and exercising again.

The hard truth is that once you wander off the path it is SO hard to find your way back. I think this is for two reasons: #1 Laziness - you know how hard it was to get where you were before and how much work it is going to take to get back to that point and you are just to lazy to put forth the effort and/or #2 Excuses - Let's face it...it's easier to make excuses and find other distractions to fill our time. If we aren't thinking about what we should be doing then we don't feel guilty about it.

So pray for me and for Jimmy as we try to get back on track. We will pray for you as well. We all have those things in our lives that we need to get back to. So this week ask yourself, do I want to? Because if you do then God is faithful to come alongside you and help you with the rest. You just have to ask.

Monday, January 24, 2011

The Little Things

I know that I have written before about how Dave Ramsey and Financial Peace University Changed My Life, but I was thinking about the little things that have changed in our lives since we started being more financially responsible. I also thought about dedicating that blog post to the two college couples in our student ministry who are getting married very soon and all the conversations I have had and will have with them about how to make their marriage strong and how to get by financially and just life in general. So as I sat there on a snowy Sunday afternoon clipping my coupons and later working on my design stuff, I thought I would write about a few of the things we do to make our marriage stronger and to get by financially.

3 Things Jimmy and I Do to Strengthen our Marriage:

3 Things We Do to Be More Stable Financially:

Ok, I know that this post was really long! Thanks for hanging in there with me. I just had so much that I am thankful for and that I wanted to share with you. I hope that some of this has been helpful to you and encouraged you.

Grace and Peace,

Christiana

Other Resources:

3 Things Jimmy and I Do to Strengthen our Marriage:

- Spend Time in Prayer

- Communicate I have to be totally honest on this one. Sometimes our communication comes out in a loud volume or in a heated discussion but at least we are communicating. We make a conscious effort to try and let the other person know what's going on. Whether that is passing on important news, what we have done today, or taking the time to resolve an argument it's important and we try. We are NOT perfect and sometimes we fail miserably at communication but the important thing is that we try.

- We say "I Love You"

3 Things We Do to Be More Stable Financially:

- Live by Our Budget

- Yes, We Clip Coupons

This one takes a lot of time and effort but you can get really great results. Now I am not an extreme couponer like the ones they have TV shows about but I do make an effort to clip coupons for products that I know I need and for ones that I already use. I don't know about you, but there are a few products (like me girl stuff) that I am always going to buy my name brand for. It just makes me feel better. So why not save some money? There are a TON of great resources out there if you want to start saving some money with coupons. I suggest starting with Coupon Mom.

This one takes a lot of time and effort but you can get really great results. Now I am not an extreme couponer like the ones they have TV shows about but I do make an effort to clip coupons for products that I know I need and for ones that I already use. I don't know about you, but there are a few products (like me girl stuff) that I am always going to buy my name brand for. It just makes me feel better. So why not save some money? There are a TON of great resources out there if you want to start saving some money with coupons. I suggest starting with Coupon Mom.- Every Little Bit Counts

Ok, I know that this post was really long! Thanks for hanging in there with me. I just had so much that I am thankful for and that I wanted to share with you. I hope that some of this has been helpful to you and encouraged you.

Grace and Peace,

Christiana

Other Resources:

Thursday, December 30, 2010

How Dave Ramsey & Financial Peace University Changed My LIfe

I don't know about you but I was 22 years old when I got married. I wasn't always one for thinking ahead. I had worked several jobs through my college life and I was holding down a job at the time. I was also in very little debt and had the blissful feeling right before entering repayment on my student loans. I thought I had everything under control when it came to money....dunt dunt duh....then I got married.

I don't know about you but I was 22 years old when I got married. I wasn't always one for thinking ahead. I had worked several jobs through my college life and I was holding down a job at the time. I was also in very little debt and had the blissful feeling right before entering repayment on my student loans. I thought I had everything under control when it came to money....dunt dunt duh....then I got married.Not only does getting married change who you are as a person, it changes every other part of your life! I married the man of my dreams but it was more than that. I married into his family. I married into his ministry. I married into his money (or lack there of -- which was more like it). I also married into his debt.

Now Jimmy and I are a unique case. For personal reasons that I won't get into here, Jimmy has a lot of unresolved debt due to theft of his identity as a small child and mounting student loans. Thankfully, he told me about all this before we got married or we could have had WAY more financial problems than we did. As it was, we only had so much income and no plan to make it work, but we had credit cards!

We used our credit cards for a few little extras on our honeymoon and then we paid some of it off. We thought we were fine. Then Jimmy was told he only had four months left of his job and we began to panic. We scrimped and we saved and we put away birthday money and Christmas money. No fun for us that year. By the time the deadline rolled around we had $2000 in savings. I still had a job and I took on another and another. We thought we would be okay, but five months later our savings were gone, our credit cards were almost maxed out, I was working three jobs, Jimmy was still searching, and we still had no plan. It was stressful and frightening! Not to mention all the stress it can put on a new marriage! But we were not alone.

According to USA Today money is one of the top 3 marriage stressers out there. So what are you going to do about it?

In July, I was let go from one of my photography jobs and as a last resort applied to a job as a night monitor at the Missouri Baptist Children's Home. It's not what I wanted and if I got it we would have to leave our wonderful apartment in South County to move to a considerably less desireable (but more affordable) apartment in North County but I had no other hope. I got the job.

In August, we moved to Bridgeton and I started work. While I was in training I learned about Dave Ramsey and Financial Peace University (FPU). God knew what he was doing when He brought me to the Children's Home and put me in Amy's (a die hard Dave fan) training class. As it turned out, Amy taught the FPU class at Ridgecrest Baptist Church. By the end of training, I was desperate to find out more about this class and I knew exactly who to go to.

When class started in September, I had a new job and so did Jimmy. We were prepared to hope that our situation could be different if we were ready to make drastic changes. We eagerly sucked up all the facts and techniques that Dave was willing to teach us and began trying to put them into practice. It was really hard at first and we were frustrated, but we knew where we would be if we quit. By the end of FPU, we had completed Baby Step #1: Put $1000 into an Emergency Fund and had begun Baby Step #2: Pay off Debt Using the Debt Snowball Method. Here we are a little over 3 years later and our life is so different!

Yes, we are still on Baby Step #2 but we have paid off more than $7,000 worth in debt with our limited incomes (guess what ministry doesn't pay much and we both have ministry jobs!). We also live by a budget that we actually know how to make work! We fight less about money (unless someone is just having a greedy or selfish moment). But best of all we have HOPE for the future. Yes, at times things still seem overwhleming, but we have a plan. I know that if we stay the course or do better than planned then we will be debt free (except student loans) in September of 2013. That means that just 6 years from starting we will have paid off more than $75,000 in debt with interest probably closer to $100,000. I think that's pretty remarkable.

I thank God for showing us how to find financial freedom. I thank God for Amy who God used to show us the way. I thank God for Dave Ramsey who God used to give us the tools, and I thank God for my husband, Jimmy, who has been with me all the way.

To find out how Financial Peace University can change your life, visit daveramsey.com or find a class near you!

this blog is dedicated to Shaina Rubin, Dustin Underwood, Shelby Conn, Kevin Little, and all people getting ready to start a new life together. may you get your marriages started off with the strong foundation and tools you need to make life easier and to help your marriages thrive.

Friday, March 12, 2010

Dumping Debt

This week Jimmy and I celebrated paying off another debt! It was so exciting to realize the relief and freedom that came when that financial burden was lifted. Although we got into debt quickly (due to a long period of unemployment and other issues), we realize that it will be a long process to work our way out. In the two years that we have been living by our financial plans and trying to become debt free, we have paid off 4 different credit accounts! Praise the Lord. Yes, we still have many more to go but we have a plan and we have a God that is good who will help us stick to it.

1.41 Million Americans declared bankruptcy in 2009 Read More

43% of Americans have less than $10,000 saved for Retirement Read More

Sadly, many people that are in debt have no idea how to get out of it.

2. Learn to Live by Your Budget

3. STOP using your Credit Cards and/or Borrowing Money

4. Make a Plan for Paying Back what you Owe

Read Dave Ramsey’s article “Get Out of Debt with the Debt Snowball Plan”

Here are the highlights for all of you that don’t have the time or the gumption to read the full article.

1. Make a List of ALL your Debts from smallest to largest

2. Start with the smallest debt you owe and pay as much as you possibly can every month on this debt while paying the minimum payments on the rest

a. This will allow you to pay this debt off quickly

b. It will help you to feel good about the victory of getting it paid off

c. The feel good feeling will help you to stick with the plan

3. When you have paid off the first debt, add all the money you were sending to the debt you have now paid off to the minimum payment from the next smallest debt and continue as before.

4. Repeat Step 3 until all debts are paid off.

CLICK HERE to read some Get Out of Debt Success Stories

Money Facts

1 in 20 American families carry more than $8,000 in credit card debt. Read More1.41 Million Americans declared bankruptcy in 2009 Read More

43% of Americans have less than $10,000 saved for Retirement Read More

Sadly, many people that are in debt have no idea how to get out of it.

How to Get Out of Debt

1. Make a Budget2. Learn to Live by Your Budget

3. STOP using your Credit Cards and/or Borrowing Money

4. Make a Plan for Paying Back what you Owe

Our Debt Snowball

As I have said before, Jimmy and I follow the skills and tactics we learned from Dave Ramsey’s Financial Peace University. This is where we first learned how to make a real budget that would actually work for us. Plus, Dave gave us some strategies to use to get out of debt. Dave calls this the “Debt Snowball”.Read Dave Ramsey’s article “Get Out of Debt with the Debt Snowball Plan”

Here are the highlights for all of you that don’t have the time or the gumption to read the full article.

1. Make a List of ALL your Debts from smallest to largest

2. Start with the smallest debt you owe and pay as much as you possibly can every month on this debt while paying the minimum payments on the rest

a. This will allow you to pay this debt off quickly

b. It will help you to feel good about the victory of getting it paid off

c. The feel good feeling will help you to stick with the plan

3. When you have paid off the first debt, add all the money you were sending to the debt you have now paid off to the minimum payment from the next smallest debt and continue as before.

4. Repeat Step 3 until all debts are paid off.

My 2¢

The hardest part of paying off debt is sticking to the plan. You WILL be tempted to use your credit cards (that’s why Dave suggests closing all your credit accounts). You will be tempted to spend the money you free up from paying off the first debt on something other than paying off the second debt. You will have setbacks once in a while. Don’t give up. This is not a task for the faint at heart! It will take a while to have total financial freedom, BUT it is POSSIBLE! Praise the Lord!Best wishes to all of you who embark on your journey to become debt free. You can do it!

CLICK HERE to read some Get Out of Debt Success Stories

Friday, February 19, 2010

Managing Money Madness Pt 2: Living by Your Budget

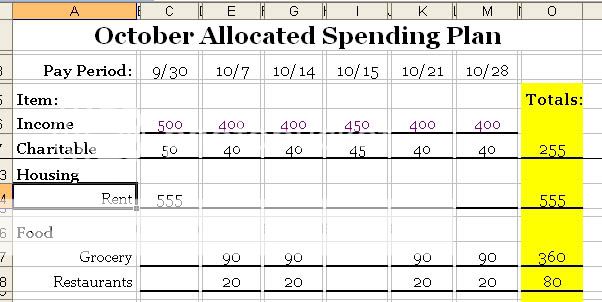

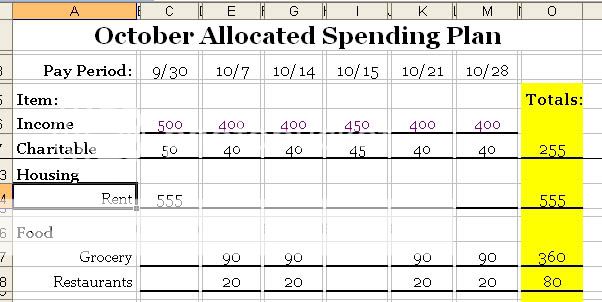

On Wednesday we talked about making a budget and having a plan. Before you read this article you should have read “Managing Money Madness Pt 1: Budgeting” and worked with your spouse to construct your budget. Now I am going to talk to you about a practical plan for putting your budget into action. Dave calls this the Allocated Spending Plan, A.S.P. for short. Jimmy and I would never be able to live by our budget if we didn’t also have an A.S.P.

What is an A.S.P. ?

You’re A.S.P. is “playbook” for each pay check. A.S.P.s can be a little complicated and overwhelming when you are first starting out, but they can be one of your biggest tools. Every month after Jimmy and I have nailed down our budget, I sit down with the Excel worksheet I created (I like Excel because I type in the numbers and it will add them all up for me—that makes me happy) and I work out our A.S.P. so I will know how much we have available in each budget category for each of our paychecks.

Making Your A.S.P.

First things first, get out your budget and keep it handy. It will be your ready reference guide while you are working on your A.S.P. as you will need to check the totals for each category as you go along. Here is a link to Dave Ramsey’s A.S.P. forms. To download a copy of my Excel ASP form, CLICK HERE.

Since I am most familiar with my own form, I will give you instructions for either making your own from scratch or using mine.

Step One: In the first column write in all the categories from your budget.

Feel free to be specific. Also be aware that some categories may not be used some months, but that doesn’t mean that you have to delete them. Once you have double checked that you have all the categories you will need, move ahead.

Step Two: Create a column for each paycheck you and your spouse receive in a single month.

For Jimmy and I this means we will either have 6 or 7 columns a month (Jimmy gets paid weekly so some months he will have five paychecks and I get paid on the 15th and the 30th). Just a note, it works best for us if we count my paycheck from the 30th of the previous month as the first paycheck for this month. Do whatever works for you, but make sure you are consistent.

Step Three: Write the amount of each paycheck under its corresponding pay date.

Step Four: Determine what will be paid from each check.

This is the hardest part when you are first starting out. A couple of things to keep in mind are: #1 you need to make sure that you have designated the money to pay bills BEFORE the bills are actually due (after all the check needs to clear the bank before you can spend it) and #2 some categories may need to be divided among different paychecks. TIP: Start with your necessities (rent, food, gas, tithe, etc.) and then fit the other amounts in where you can.

Step Five: Double and Triple check that your paycheck and expenses in each column are equal.

You can’t spend more in a week than you make and expect for your budgeting to succeed. So this step is very important. Trust me it might leave you with some pretty funny numbers but it will all work out in the end. If you do have more expenses than you have paycheck for that week then try moving things around to equal things out.

Step Six: Make sure that your budget totals and the row totals for the corresponding category match. Example, if I have $255 dollars budgeted for my tithe then my total for the charitable row should equal $255. If your totals do not equal, go back and correct any errors then repeat steps 4 and 5.

CONGRATULATIONS! You have successfully finished your first A.S.P. !

What Do I Do Now?

Now that you have finished your budget and you’re A.S.P. you are ready to put your plan into action. When your first paycheck rolls around, pull out you’re A.S.P. and see what needs to be paid this week, what needs to be saved this week, etc. Different people have different methods of doing this. Dave Ramsey and I advocate using cash and the envelope system. To learn more about the envelope system, CLICK HERE. Once you know how much you are supposed to spend and what you are supposed to be spending it on, you can do it!

Closing Remarks

Remember this is going to take a little while to get used to and it won’t be perfect the first month. Make notes of things that you need to change so you will remember to make adjustments when you sit down to work on your budget and A.S.P. for next month. Most of all just do the best you can to stick to the plan. Lifestyle changes take lots of time and effort. The important thing is that you are trying.

Additional Resources

To download a copy of my Excel Budget form, CLICK HERE.

What is an A.S.P. ?

You’re A.S.P. is “playbook” for each pay check. A.S.P.s can be a little complicated and overwhelming when you are first starting out, but they can be one of your biggest tools. Every month after Jimmy and I have nailed down our budget, I sit down with the Excel worksheet I created (I like Excel because I type in the numbers and it will add them all up for me—that makes me happy) and I work out our A.S.P. so I will know how much we have available in each budget category for each of our paychecks.

Making Your A.S.P.

First things first, get out your budget and keep it handy. It will be your ready reference guide while you are working on your A.S.P. as you will need to check the totals for each category as you go along. Here is a link to Dave Ramsey’s A.S.P. forms. To download a copy of my Excel ASP form, CLICK HERE.

Since I am most familiar with my own form, I will give you instructions for either making your own from scratch or using mine.

Step One: In the first column write in all the categories from your budget.

Feel free to be specific. Also be aware that some categories may not be used some months, but that doesn’t mean that you have to delete them. Once you have double checked that you have all the categories you will need, move ahead.

Step Two: Create a column for each paycheck you and your spouse receive in a single month.

For Jimmy and I this means we will either have 6 or 7 columns a month (Jimmy gets paid weekly so some months he will have five paychecks and I get paid on the 15th and the 30th). Just a note, it works best for us if we count my paycheck from the 30th of the previous month as the first paycheck for this month. Do whatever works for you, but make sure you are consistent.

Step Three: Write the amount of each paycheck under its corresponding pay date.

Step Four: Determine what will be paid from each check.

This is the hardest part when you are first starting out. A couple of things to keep in mind are: #1 you need to make sure that you have designated the money to pay bills BEFORE the bills are actually due (after all the check needs to clear the bank before you can spend it) and #2 some categories may need to be divided among different paychecks. TIP: Start with your necessities (rent, food, gas, tithe, etc.) and then fit the other amounts in where you can.

Step Five: Double and Triple check that your paycheck and expenses in each column are equal.

You can’t spend more in a week than you make and expect for your budgeting to succeed. So this step is very important. Trust me it might leave you with some pretty funny numbers but it will all work out in the end. If you do have more expenses than you have paycheck for that week then try moving things around to equal things out.

Step Six: Make sure that your budget totals and the row totals for the corresponding category match. Example, if I have $255 dollars budgeted for my tithe then my total for the charitable row should equal $255. If your totals do not equal, go back and correct any errors then repeat steps 4 and 5.

CONGRATULATIONS! You have successfully finished your first A.S.P. !

What Do I Do Now?

Now that you have finished your budget and you’re A.S.P. you are ready to put your plan into action. When your first paycheck rolls around, pull out you’re A.S.P. and see what needs to be paid this week, what needs to be saved this week, etc. Different people have different methods of doing this. Dave Ramsey and I advocate using cash and the envelope system. To learn more about the envelope system, CLICK HERE. Once you know how much you are supposed to spend and what you are supposed to be spending it on, you can do it!

Closing Remarks

Remember this is going to take a little while to get used to and it won’t be perfect the first month. Make notes of things that you need to change so you will remember to make adjustments when you sit down to work on your budget and A.S.P. for next month. Most of all just do the best you can to stick to the plan. Lifestyle changes take lots of time and effort. The important thing is that you are trying.

Additional Resources

To download a copy of my Excel Budget form, CLICK HERE.

Wednesday, February 17, 2010

Managing Money Madness Pt 1: Budgeting

Yesterday we talked about Money Madness and how it all begins by losing perspective on the role money should play in your life and your marriage. Over the next couple of days (or however long), I want to provide you with some tools to help keep your perspectives in their proper place and to help you manage the money madness.

Budget –noun

In Christiana terms, a budget is my plan for what to do with my money this month. Now that we have talked about what a budget is, we can talk about how to make a budget.

*Your budget MOST LIKELY will change each month although some items will remain the same.

*The key to a successful budget it to PLAN AHEAD. You might not need to have any car repairs done this month, but if you plan ahead and budget $20 a month for car repairs that you save until you do need them then when your car breaks down and costs $400 to fix it won't be nearly as stressful because you have been saving money toward such an event.

Now back to making your budget. The best option is to make what is called a zero based budget. This means that you plan for ALL money you make with a remainder of $0 unplanned. This means that you will even plan how much spending money you and your spouse will get to do whatever you want with it. I suggest that you start filling in the form by writing in your necessities housing, food, transportation, etc. Then work on your other priorities such as bills. Finally, use the remainder for savings, spending, etc. NOTE: DON'T FORGET TO TITHE! I personally believe that this should be #1. Jimmy and I have found that when we commit to giving God His money first, we will always have enough to pay for our necessities even if we don't always know where the money is going to come from.

Tool Number One: Budgeting

Many of us have heard about budgeting and that it's important, but if you're like me I never actually knew how to set up a budget that works until a little over two years ago. Having a plan in place has tremendously reduced the money stress for Jimmy and I. It's not that we make more; it's just that we are better stewards of the money God has given us because we now have a plan in place to help us accomplish our goals.What is Budgeting?

According to Dictionary.com these are just some of the definitions of the word "Budget".Budget –noun

| 1. | an estimate, often itemized, of expected income and expense for a given period in the future. |

| 2. | a plan of operations based on such an estimate. |

| 3. | an itemized allotment of funds, time, etc., for a given period. |

| 4. | the total sum of money set aside or needed for a purpose: the construction budget. |

In Christiana terms, a budget is my plan for what to do with my money this month. Now that we have talked about what a budget is, we can talk about how to make a budget.

Making a Simple Budget

One of the things that helped Jimmy and I to get our finances on track was taking one of Dave Ramsey's Financial Peace University (FPU) classes. The course covers all the basics of budgeting, getting out of debt, planning for the future, investing, and more. It was a very useful class so I want to pause a moment and give you some links to more information about FPU and Dave Ramsey. If you want to know more about Dave Ramsey, click here. If you would like more information about an FPU class in your area, click here. Part of the reason I wanted to give you these links is because Dave has really helped us and part of it is because I want to refer you to Dave's simple budgeting forms to help you make your own plan.Step One: Figure out How Much You Make Each Month

Add up all income sources for you and your spouse to get the total amount of income you will have for the month. I know that this is trickier for some because you are not salaried or you might work on commission. If you are in these situations, I would base your total income off an average of your income for the last few months. This might take a little research on your part but you can do it!Step Two: List all Your Bills and Expenses for the Month

The first part is easy. Most of us know which bills we have to pay every month and about how much they are going to cost. So write them all out (I would also make a note of when payment is due--we will use this later). Now that you have listed rent/house payment, car payments, cell phones, internet, cable, credit card payments, school loan payments, etc. It's time to work on the expenses. This is a little tricky and may take some estimating. Do the best you can in estimating how much you spend on clothing, hair cuts, toiletries, medications, gas, food, etc. Don't worry you will probably change this later anyway, so just give your best estimate for now.Step Three: Make Your Budget

Now this is the truly hard part. It's not that the dividing of funds is hard. It's seeing just how out of whack our finances can be that is hard. CLICK HERE for Dave's downloadable budget forms. They are easy to use and they can help you to think of areas you might have missed.A COUPLE OF NOTES

*Your budget WILL NOT be perfect the first time! Dave estimates that it takes 3 to 4 months for you to get most of the bugs worked out of your budget.*Your budget MOST LIKELY will change each month although some items will remain the same.

*The key to a successful budget it to PLAN AHEAD. You might not need to have any car repairs done this month, but if you plan ahead and budget $20 a month for car repairs that you save until you do need them then when your car breaks down and costs $400 to fix it won't be nearly as stressful because you have been saving money toward such an event.

Now back to making your budget. The best option is to make what is called a zero based budget. This means that you plan for ALL money you make with a remainder of $0 unplanned. This means that you will even plan how much spending money you and your spouse will get to do whatever you want with it. I suggest that you start filling in the form by writing in your necessities housing, food, transportation, etc. Then work on your other priorities such as bills. Finally, use the remainder for savings, spending, etc. NOTE: DON'T FORGET TO TITHE! I personally believe that this should be #1. Jimmy and I have found that when we commit to giving God His money first, we will always have enough to pay for our necessities even if we don't always know where the money is going to come from.

Give It a Go!

So take some time and have a "budget meeting" with your spouse. Do your best to estimate your income and expenses. If you need helps or have comments/questions, feel free to come back and post or you can look for answers on Dave Ramsey's Website. Happy budgeting!

Subscribe to:

Posts (Atom)