Have you ever met that one person who cannot see past the next ten minutes of the day? Everything is dramatic and the world is always coming to an end. Oh wait! We all know teenagers! Sadly, many adults live this way too.

As Christians, God calls us to be big picture people. That doesn’t mean that we have everything planned out to the letter for the next twenty years of our lives (read the dangers of this in James 4), but it does mean thinking of more than the moment. I think you could make a valid case that all successful individuals practice big picture perspective.

When people with big picture perspective encounter choices, crisis, opportunities, and struggles they stop for a minute to think. Before making any decisions they think, “What consequences good or bad could come from how I handle this situation?” Teenagers are notorious for rushing headlong into situations without a moments thought.

For example, if Andrew wants to get a tattoo he should stop and ask himself a few questions. Will I still want this tattoo when I 30+? Is my chosen location for the tattoo appropriate for my future career choice? *Side Note: I know some churches and other ministry employers that will not hire if you have a tattoo at all let alone if you have one on your face!* But many people don’t stop to give these questions and others any consideration.

This lack of big picture perspective has corroded so many things in our lives. Our rash decisions from the past are haunting us now. We regret the people we’ve dated, the jobs we’ve taken, or the places we have lived. Yes, God uses these choices to help us to learn and to influence the person we have become, but just think of the pain and regret that could have been avoided with just a little bit of thought!

Take 5 minutes today and think about how the decisions you are making could be affecting your future. You might be surprised at what you discover!

Showing posts with label spending plans. Show all posts

Showing posts with label spending plans. Show all posts

Friday, May 21, 2010

Friday, February 19, 2010

Managing Money Madness Pt 2: Living by Your Budget

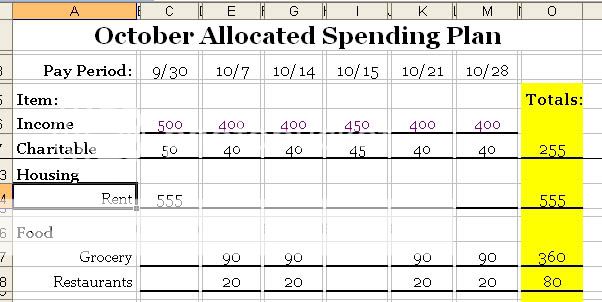

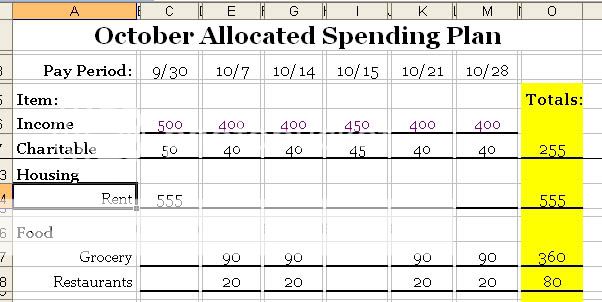

On Wednesday we talked about making a budget and having a plan. Before you read this article you should have read “Managing Money Madness Pt 1: Budgeting” and worked with your spouse to construct your budget. Now I am going to talk to you about a practical plan for putting your budget into action. Dave calls this the Allocated Spending Plan, A.S.P. for short. Jimmy and I would never be able to live by our budget if we didn’t also have an A.S.P.

What is an A.S.P. ?

You’re A.S.P. is “playbook” for each pay check. A.S.P.s can be a little complicated and overwhelming when you are first starting out, but they can be one of your biggest tools. Every month after Jimmy and I have nailed down our budget, I sit down with the Excel worksheet I created (I like Excel because I type in the numbers and it will add them all up for me—that makes me happy) and I work out our A.S.P. so I will know how much we have available in each budget category for each of our paychecks.

Making Your A.S.P.

First things first, get out your budget and keep it handy. It will be your ready reference guide while you are working on your A.S.P. as you will need to check the totals for each category as you go along. Here is a link to Dave Ramsey’s A.S.P. forms. To download a copy of my Excel ASP form, CLICK HERE.

Since I am most familiar with my own form, I will give you instructions for either making your own from scratch or using mine.

Step One: In the first column write in all the categories from your budget.

Feel free to be specific. Also be aware that some categories may not be used some months, but that doesn’t mean that you have to delete them. Once you have double checked that you have all the categories you will need, move ahead.

Step Two: Create a column for each paycheck you and your spouse receive in a single month.

For Jimmy and I this means we will either have 6 or 7 columns a month (Jimmy gets paid weekly so some months he will have five paychecks and I get paid on the 15th and the 30th). Just a note, it works best for us if we count my paycheck from the 30th of the previous month as the first paycheck for this month. Do whatever works for you, but make sure you are consistent.

Step Three: Write the amount of each paycheck under its corresponding pay date.

Step Four: Determine what will be paid from each check.

This is the hardest part when you are first starting out. A couple of things to keep in mind are: #1 you need to make sure that you have designated the money to pay bills BEFORE the bills are actually due (after all the check needs to clear the bank before you can spend it) and #2 some categories may need to be divided among different paychecks. TIP: Start with your necessities (rent, food, gas, tithe, etc.) and then fit the other amounts in where you can.

Step Five: Double and Triple check that your paycheck and expenses in each column are equal.

You can’t spend more in a week than you make and expect for your budgeting to succeed. So this step is very important. Trust me it might leave you with some pretty funny numbers but it will all work out in the end. If you do have more expenses than you have paycheck for that week then try moving things around to equal things out.

Step Six: Make sure that your budget totals and the row totals for the corresponding category match. Example, if I have $255 dollars budgeted for my tithe then my total for the charitable row should equal $255. If your totals do not equal, go back and correct any errors then repeat steps 4 and 5.

CONGRATULATIONS! You have successfully finished your first A.S.P. !

What Do I Do Now?

Now that you have finished your budget and you’re A.S.P. you are ready to put your plan into action. When your first paycheck rolls around, pull out you’re A.S.P. and see what needs to be paid this week, what needs to be saved this week, etc. Different people have different methods of doing this. Dave Ramsey and I advocate using cash and the envelope system. To learn more about the envelope system, CLICK HERE. Once you know how much you are supposed to spend and what you are supposed to be spending it on, you can do it!

Closing Remarks

Remember this is going to take a little while to get used to and it won’t be perfect the first month. Make notes of things that you need to change so you will remember to make adjustments when you sit down to work on your budget and A.S.P. for next month. Most of all just do the best you can to stick to the plan. Lifestyle changes take lots of time and effort. The important thing is that you are trying.

Additional Resources

To download a copy of my Excel Budget form, CLICK HERE.

What is an A.S.P. ?

You’re A.S.P. is “playbook” for each pay check. A.S.P.s can be a little complicated and overwhelming when you are first starting out, but they can be one of your biggest tools. Every month after Jimmy and I have nailed down our budget, I sit down with the Excel worksheet I created (I like Excel because I type in the numbers and it will add them all up for me—that makes me happy) and I work out our A.S.P. so I will know how much we have available in each budget category for each of our paychecks.

Making Your A.S.P.

First things first, get out your budget and keep it handy. It will be your ready reference guide while you are working on your A.S.P. as you will need to check the totals for each category as you go along. Here is a link to Dave Ramsey’s A.S.P. forms. To download a copy of my Excel ASP form, CLICK HERE.

Since I am most familiar with my own form, I will give you instructions for either making your own from scratch or using mine.

Step One: In the first column write in all the categories from your budget.

Feel free to be specific. Also be aware that some categories may not be used some months, but that doesn’t mean that you have to delete them. Once you have double checked that you have all the categories you will need, move ahead.

Step Two: Create a column for each paycheck you and your spouse receive in a single month.

For Jimmy and I this means we will either have 6 or 7 columns a month (Jimmy gets paid weekly so some months he will have five paychecks and I get paid on the 15th and the 30th). Just a note, it works best for us if we count my paycheck from the 30th of the previous month as the first paycheck for this month. Do whatever works for you, but make sure you are consistent.

Step Three: Write the amount of each paycheck under its corresponding pay date.

Step Four: Determine what will be paid from each check.

This is the hardest part when you are first starting out. A couple of things to keep in mind are: #1 you need to make sure that you have designated the money to pay bills BEFORE the bills are actually due (after all the check needs to clear the bank before you can spend it) and #2 some categories may need to be divided among different paychecks. TIP: Start with your necessities (rent, food, gas, tithe, etc.) and then fit the other amounts in where you can.

Step Five: Double and Triple check that your paycheck and expenses in each column are equal.

You can’t spend more in a week than you make and expect for your budgeting to succeed. So this step is very important. Trust me it might leave you with some pretty funny numbers but it will all work out in the end. If you do have more expenses than you have paycheck for that week then try moving things around to equal things out.

Step Six: Make sure that your budget totals and the row totals for the corresponding category match. Example, if I have $255 dollars budgeted for my tithe then my total for the charitable row should equal $255. If your totals do not equal, go back and correct any errors then repeat steps 4 and 5.

CONGRATULATIONS! You have successfully finished your first A.S.P. !

What Do I Do Now?

Now that you have finished your budget and you’re A.S.P. you are ready to put your plan into action. When your first paycheck rolls around, pull out you’re A.S.P. and see what needs to be paid this week, what needs to be saved this week, etc. Different people have different methods of doing this. Dave Ramsey and I advocate using cash and the envelope system. To learn more about the envelope system, CLICK HERE. Once you know how much you are supposed to spend and what you are supposed to be spending it on, you can do it!

Closing Remarks

Remember this is going to take a little while to get used to and it won’t be perfect the first month. Make notes of things that you need to change so you will remember to make adjustments when you sit down to work on your budget and A.S.P. for next month. Most of all just do the best you can to stick to the plan. Lifestyle changes take lots of time and effort. The important thing is that you are trying.

Additional Resources

To download a copy of my Excel Budget form, CLICK HERE.

Subscribe to:

Posts (Atom)